Amy, who generously penned our Drug Development Wednesday series, is back to discuss coverage options and payment strategies in the United States. This guest column will include three blogs and discuss different ways people may face easy access to medications or challenging and costly hurdles. It’s important to note that what is discussed below may not apply to you depending on your coverage situation. It is also important to note that different states have different policies in place, which may affirm or negate the topics discussed. This blog series is intended to get you thinking about payment strategies, but not necessarily describe the one that will work the best. It is up to you to evaluate different options, wherein the responsibility of what coverage solution you pursue rests solely on your shoulders. This blog series should not represent your sole source for determining healthcare coverage.

With any luck, the triple combo will be approved and branded soon. This is obviously an incredibly exciting time for the CF community and the hope of improved health is on the mind of nearly everyone with CF.

Open enrollment will be upon us soon, and I want to throw out a few pointers as you examine your health insurance plan for 2020.

It’s important to note that what follows are suggestions only. The health insurance landscape, Medicare, Medicaid, drug company support programs, and independent nonprofits that offer assistance can change at any time. What follows is broad commentary and may or may not necessarily apply to your specific case.

I’m going to divide this topic in to 3 parts because the topic is dense and complicated. We will start with private insurance first, then Medicare, and lastly accumulator adjustment programs and 3rd party assistance programs.

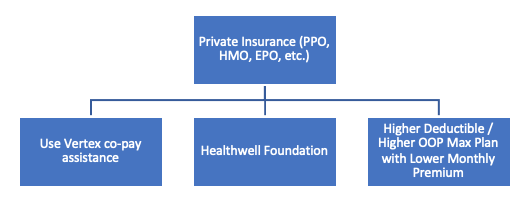

Private Insurance

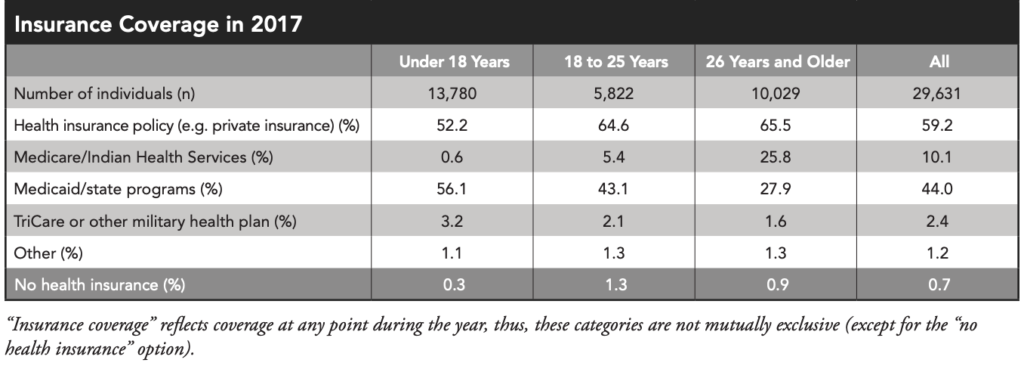

In 2017, approximately 59% of all people with CF in the US had private insurance at some point, with nearly 66% of people with CF aged 26+ covered by private insurance ( PPO, HMO, EPO ). A few points to keep in mind regarding private insurance in 2020:

Co-pay Assistance Program

Those with private insurance are eligible under federal law for co-pay assistance programs. As of this writing, Vertex’s assistance program covers the vast majority of the patient’s co-insurance responsibility for Vertex drugs. Bottomline, this Vertex co-pay assistance program can minimize out of pocket cost for modulators and may also have some nice perks as well.

Deductibles and OOP Max

Often times with private insurance, medical and pharmacy benefits are combined to meet an annual out of pocket (OOP) maximum. Once the insured reaches a certain $ out of pocket on an annual basis, all other costs for healthcare (medical and pharmacy) for the remainder of the calendar year are covered at 100% by insurance.

Why does this matter? You can focus the timing of filling your medications to take advantage of this benefit. If you can time your filling of the medication (any medication) that has a manufacturer co-pay assistance program, then you can get the assistance program to pay for the deductible instead of you having to pay it yourself. In addition, co-pay assistance programs may pay a good amount of your share of the annual OOP max, therefore killing two birds with one stone.

Once you satisfy the annual OOP max, any hospital visit, doctor visit, test, procedure or medication (if OOP max for medical and pharmacy benefits are combined) for the remainder of the year is covered by insurance at 100% resulting in a $0 OOP cost for you. OOP max = your friend. Figure out what it is for your plan and strategize how to reach it most efficiently.

Even if medical and pharmacy benefits aren’t combined in the insurance plan for the annual OOP max, the drug manufacturer’s co-pay assistance program will likely allow you to hit the pharmacy benefit OOP max for the year very quickly if you’re on a modulator. Which of course means the cost of medications for the rest of the year is $0 because the pharmacy benefit OOP max has been satisfied.

Often, private insurance deductibles are combined for medical and pharmacy benefits. So just like the example above, co-pay assistance programs can help to overcome deductibles.

Higher Deductible / Higher OOP Max with Lower Premium Plan

As a result of the information above, if you are on an expensive drug like a modulator, it may be worth doing the math on an insurance plan that has a higher deductible / higher OOP max and a lower monthly premium. The lower monthly premium could save you a great deal of money, and because the manufacturer copay assistance program may get you through a higher deductible / higher OOP max with little to no cost to you. It’s a worthwhile strategy to examine. For the sake of the folks who don’t have access to a modulator yet, we are hoping the triple combo is approved. If it receives approval mid to late 2020, this strategy may not be as relevant for 2020 because by that time of the year, many with private insurance have already satisfied their deductible and maybe even their OOP max for the year. This strategy really works well if you are on the expensive medication from the beginning of the year; so paying very close attention to when Vertex submits the New Drug Application (NDA) to the FDA, which the company has indicated may happen soon, will give you a chance to follow the FDA’s timeline.

Of course, if you’re already on Kalydeco, Orkambi or Symdeko, you can implement this strategy for 2020 if the calculations work out in your favor. And it is worth repeating that we don’t know if Vertex will change their copay assistance program in 2020 so this strategy may or may not be relevant then, but it’s something to consider.

Also look out for Accumulator Adjustment / Copay Accumulator programs, which Gunnar has written about, and will be discussed later in this blog series. Without going too far into it yet, the aforementioned programs could definitely alter your choice for the strategy discussed above.

You can always consult CFF Compass or your clinic’s social worker for more information.

Hopefully you can now see that there are several paths you can take with private insurance to keep your out of pocket costs down. Stay tuned for the next post on Medicare where I will discuss a few different strategies for dealing with costly medications.

The views expressed on any guest column [Coverage Tips for Costly Drugs], are that of guest contributors, and not necessarily those of Gunnar Esiason or the Boomer Esiason Foundation. Nothing in these blogs/articles should be considered medical or financial advice; such advice can only be given by a physician or certified professional who is experienced with cystic fibrosis, healthcare coverage or state and federal laws. The Boomer Esiason Foundation, Gunnar Esiason, and guests cannot be held responsible for any damage which may result from using the information on this website.