Amy is back with the second installment of her miniseries Coverage Tips for Costly Drugs. Today she is going to take you through the Medicare landscape, which as you will see below can be a bit tricky. It’s important to note that what is discussed below may not apply to you depending on your coverage situation. It is also important to note that different states have different policies in place, which may affirm or negate the topics discussed. This blog series is intended to get you thinking about payment strategies, but not necessarily describe the one that will work the best. It is up to you to evaluate different options, wherein the responsibility of what coverage solution you pursue rests solely on your shoulders. This blog series should not represent your sole source for determining healthcare coverage.

In the last post, we discussed navigating private insurance. As you will see, those with Medicare are in a pretty different situation than those with private insurance, and special attention needs to be paid to keeping out of pocket costs down.

Please still keep in mind: what follows are suggestions only. The health insurance landscape, Medicare, Medicaid, drug company support programs, and independent nonprofits that offer assistance can change at any time. What follows is broad commentary and may or may not necessarily apply to your specific case.

Medicare

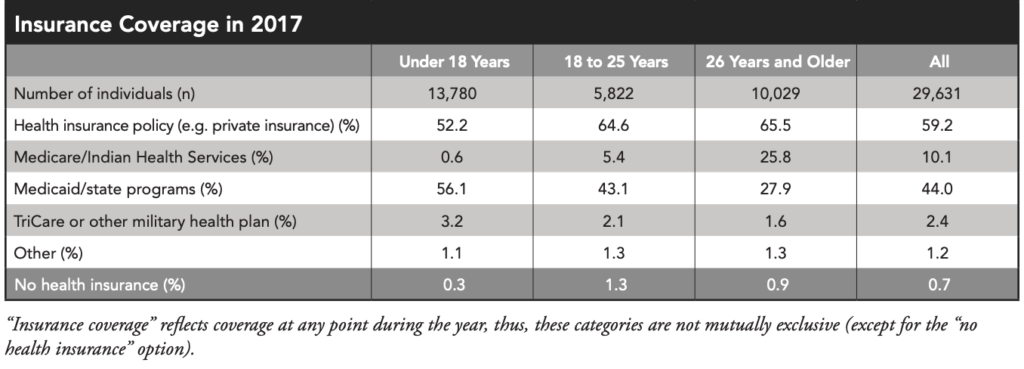

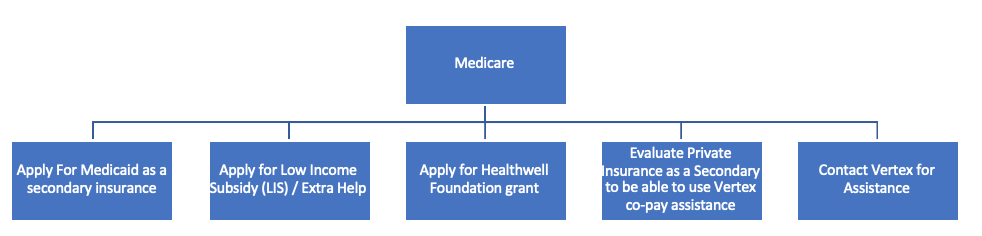

10% of the total CF population in the US has Medicare (around 3300 people with CF), but that number jumps for those above 26 years of age to nearly 26% in the US, that’s 1 out of 4. Medicare can be slightly more challenging for those on multiple medications as well as those who have high cost drugs with no generic alternative such as orphan disease medications. The federal government does not allow drug manufacturers to help patients with their traditional co-pay assistance programs. A few points to keep in mind:

Getting a secondary plan (not the same thing as a supplemental plan).

Medicare is amazing and is extremely helpful for the CF community. While I, of course, am not discouraging anyone from using their Medicare benefits in the context of modulators, if you can ALSO get ahold of a private insurance plan (not to be confused with Medicare Part C / Medicare Advantage, and not to be confused with a supplemental plan), IN ADDITION to traditional Medicare / fee for service Medicare, do it.

What follows isn’t going to work if you have a Medicare Advantage Plan (otherwise known as Medicare Part C, where your Parts A, B and D are all rolled in to one insurance plan).

DO NOT GET RID OF YOUR MEDICARE. Say it out loud. I AM NOT TELLING YOU TO GET RID OF YOUR MEDICARE. Instead, here is what I’m saying:

Consider getting a private insurer to cover prescription drugs in lieu of Medicare Part D.

For example, maybe you have a spouse who has health insurance through his or her employer – it’s worth looking in to possibly obtaining a private insurance plan for coverage of high cost drugs. Many people think, “isn’t it redundant or not cost effective to pay premiums on a second insurance policy?” Maybe in the past. Maybe it still is. But I want to encourage everyone reading this to do a calculation to see if this is worth it. Hear me out:

The federal government allows drug companies to give co-pay assistance to private insurance holders as discussed above. But if you have Medicare Part D (Medicare Part D pays for prescription drugs), the federal government doesn’t allow you to use co-pay assistance programs. You can read Gunnar’s blog post from a few months to learn why. But if you have a private insurance plan in place to pay for prescription drugs in addition to Medicare, this will allow you to use manufacturer co-pay assistance programs because the insurance plan isn’t federally funded.

So, for example, let’s say getting access to your spouse’s private insurance as a secondary plan in addition to your fee for service (FFS) Medicare costs $500/month. Sounds like a lot of money. $6,000 a year. However, if you have Medicare Part D without Extra Help/Low Income Subsidy or state Medicaid, and you don’t qualify for 3rd party assistance programs grants (to be discussed in the next blog post), you could be looking to pay ~ $19,000 or more a year for a modulator alone (see more details here).

Keep in mind, this $19,000 OOP doesn’t include co-pays for Pulmozyme, Cayston, TOBI, pancreatic enzymes, etc. (remember, because you have Medicare Part D, you can’t use manufacturer co-pay programs). So as you can see in the example above, $19,000/year is much more than $6,000 a year, so you might want to do your own calculations for what different scenarios will cost you. If you have a private insurance as a secondary to Medicare, you also won’t have to purchase Part D if that private insurance has drug coverage – which amounts to a pretty big cost savings as well. Definitely check out my previous blog post to understand using manufacture co-pay assistance programs, and why in some cases private insurers circumvent assistance programs via an accumulator adjustor.

Another tip about secondary insurance, if private insurance isn’t an option for you, is to double check your state’s policies to see if you qualify for Medicaid. Medicaid can sometimes help pay for part or all of drug co-pays that Medicare Part D isn’t covering. That can save you a lot of money, especially with modulators or high cost drugs.

Assistance for those specifically with Medicare

Low Income Subsidy or Extra Help is a program for lower income individuals on Medicare who don’t have Medicaid or Supplemental Security Income (SSI) to help pay for healthcare costs. This program can help pay for some of the OOP costs for medications. Eligibility criteria can be found here.

A quick note about Medicare Advantage (Medicare Part C)

Sadly, Medicare Advantage plans most often follow the same pharmacy benefit deductible, donut hole and catastrophic coverage calculation as Medicare Part D. There is also often no OOP max with Medicare Advantage, just like Medicare Part D, so it’s doubtful you will be saving money on modulator co-pays if you enroll in Medicare Advantage. You are also likely limiting your choice of doctors by turning your benefits over to a Medicare Advantage plan (it is commonly known that not all doctors are contracted with Medicare Advantage plans – but most doctors are contracted with FFS Medicare). Medicare Advantage plans can be helpful in some scenarios, but I want to be clear that in many cases these plans may not help with large drug costs.

While Medicare can be a bit more difficult to navigate than private insurance plans, hopefully you can see now that you aren’t without options of how to lower your out of pocket costs. I believe firmly there is ALWAYS a way to work through these issues even as the landscape continues to change. The third and final blog in this series will tackle the dreaded accumulator adjustment programs (aka co-pay accumulator programs) as well as a deeper dive in to 3rd party assistance programs. I look forward to seeing you then!

The views expressed on any guest column [Coverage Tips for Costly Drugs], are that of guest contributors, and not necessarily those of Gunnar Esiason or the Boomer Esiason Foundation. Nothing in these blogs/articles should be considered medical or financial advice; such advice can only be given by a physician or certified professional who is experienced with cystic fibrosis, healthcare coverage or state and federal laws. The Boomer Esiason Foundation, Gunnar Esiason, and guests cannot be held responsible for any damage which may result from using the information on this website.